IRS Rules for Donation Tax Deductions in 2025: What You Need to Know?

Giving with Confidence: What Donors Need to Know in 2025 If you are a dedicated taxpayer and believe in giving,…

Read More

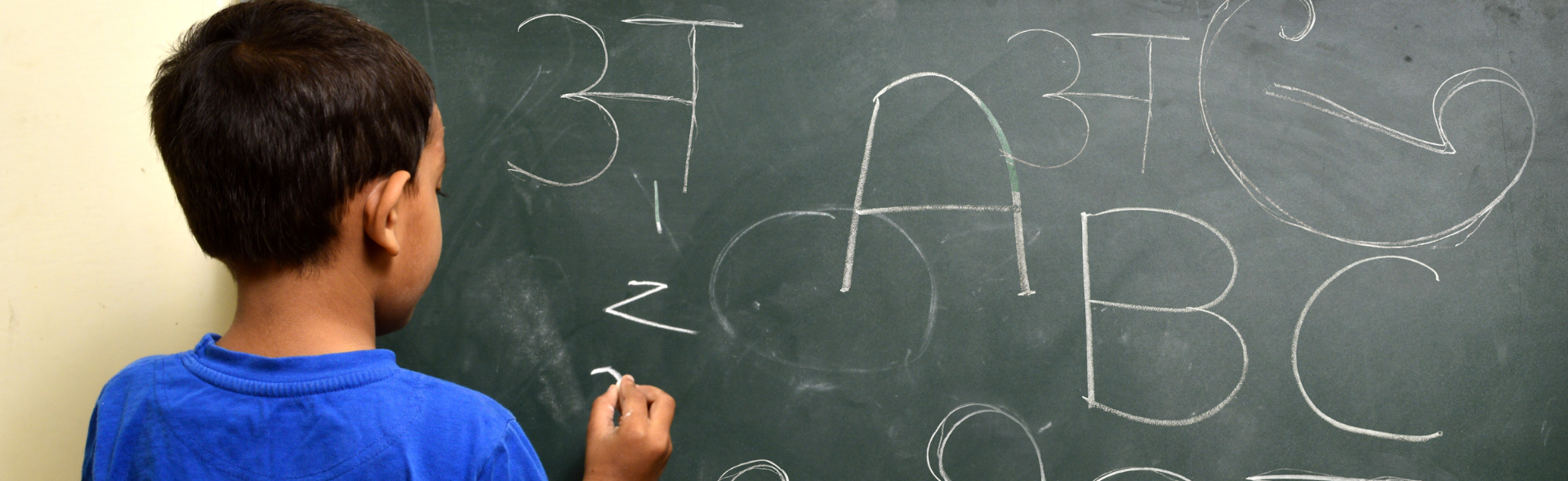

How Activity-Based Learning Boosts Knowledge and Retention?

Understanding Activity Method of Teaching In the evolving educational world, traditional teaching methods are gradually being replaced by interactive and…

Read More

How Does the Anganwadi Feeding Programme Nourish Young Lives?

Anganwadi and its Role in Child Welfare India has made significant strides in improving child health and education, with the…

Read More

What Was Tagore’s Vision of Education and Its Philosophy?

Understanding the Contribution of Rabindranath Tagore in Education Rabindranath Tagore, one of the greatest Indian educational philosophers, envisioned an education…

Read More

How Can We Stop Child Marriage in India and Secure a Brighter Future?

A Brighter Future for Every Child Child marriage was once a common practice in India, but over the years, significant…

Read More

Types of Donations Eligible for 80G Deductions

Give and Gain with a Good Cause Picture this: You come across a story about a child who dreams of…

Read MoreExplore more Resources

Ready to brush up on something new? We've got more to read right this way.