Make a contribution to support a child’s education and get income tax exemption

Every financial year, a lot of people have to pay income tax. However, if you take certain steps, you can get a donation rebate in income tax.

Here’s your chance to Double Your Impact: Make a contribution to Bal Raksha Bharat to support a child’s education and get income tax exemption under Section 80G deduction.

HOW A CHARITABLE DONATION TO BAL RAKSHA BHARAT CAN HELP IN INCOME TAX DEDUCTION

Education is the best gift you can ever give. Imagine supporting the education of a child and enabling them to build a future – the joy and satisfaction you would receive will be unparalleled. When you donate to support Bal Raksha Bharat’s education projects, you are eligible to avail income tax donation exemption under Section 80G of the Income Tax Act, 1961. Your act of kindness goes a long way in supporting the education of India’s most vulnerable and marginalized children and earns you rewards in the form of tax savings.

As per the Indian Income Tax Department’s rules, a donor is required to add their address and PAN number in case they wish to receive the 80G tax-exemption certificate

Make a contribution to support a child’s education and get tax exemption

Every financial year, a lot of people have to pay income tax. However, if you take certain steps, you can get a donation rebate in income tax.

Here’s your chance to Double Your Impact: Make a contribution to Bal Raksha Bharat to support a child’s education and get tax-exemption under Section 80G.

DONATE TO BAL RAKSHA BHARAT For DONATION TAX DEDUCTION

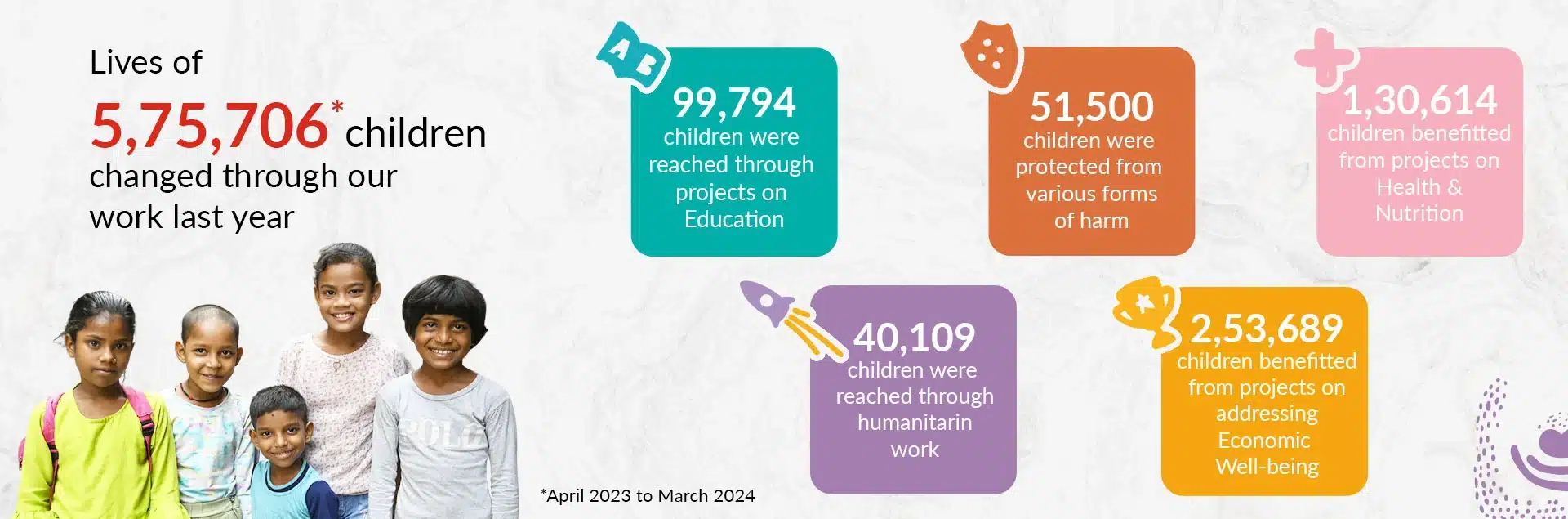

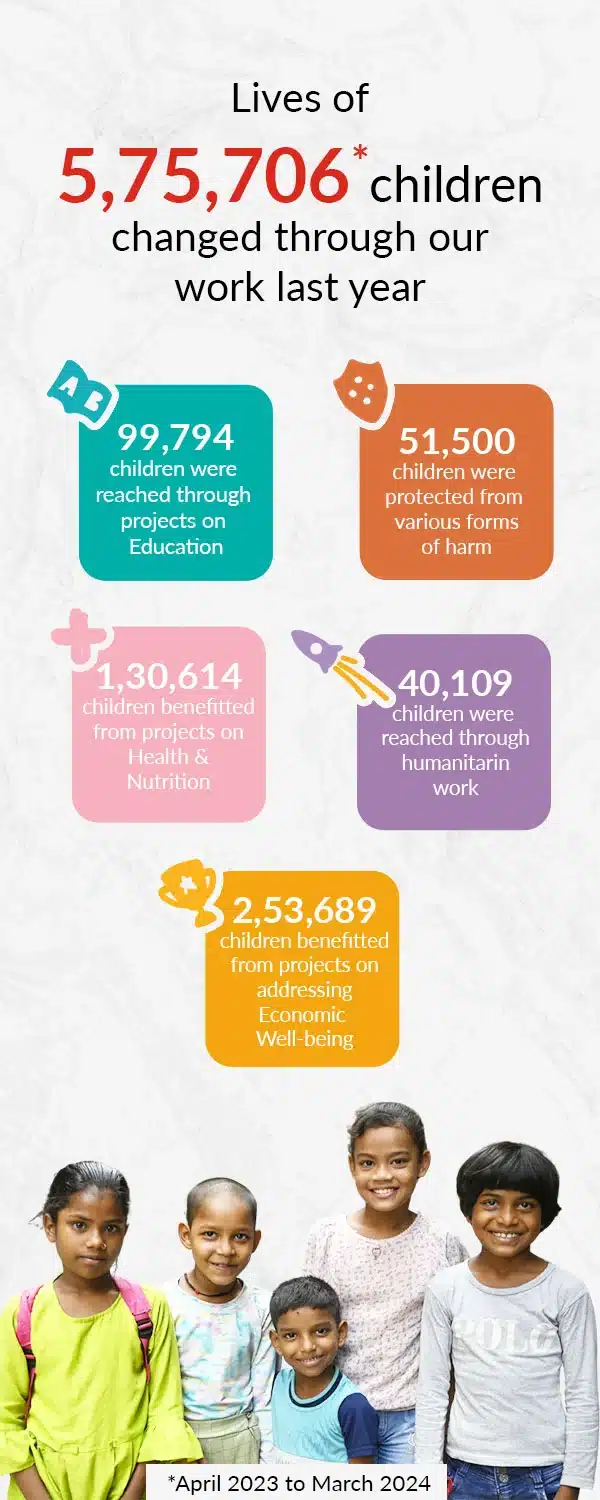

Donating to Bal Raksha Bharat is a true investment in the future of India – its children. We have been working relentlessly since 2004 and have impacted the lives of more than 10 million children. We are committed towards helping the children of India build a Secure Childhood and thus a Secure Future.

Come, make a contribution today to reap dual benefits: the joy and satisfaction of changing a life and the reward of donation tax deduction.

Claim Income Tax Exemption by Donating to Bal Raksha Bharat’s Transformative Education Programmes

Managing income tax liabilities can be an overwhelming task for most individuals each financial year. However, this also provides an opportunity to give back to society as well. When you donate to organisations like Bal Raksha Bharat to support a child’s education, you can save up to 50% income tax donation exemption under the Income Tax Act, which is quite significant. Additionally, with 50% tax exemption on donation under Section 80G of the Income Tax Act, you can fully deduct the amount you have donated for social welfare. Knowing how to donate within the terms of 80G income tax allows you to incorporate effective financial strategies into your system while benefiting underprivileged children in the process.

Understanding the 80G Income Tax Benefit

When one makes a donation, it makes you eligible to receive a donation exemption in income tax under 80G of the income tax regulation, which can significantly reduce your taxable income. This is especially beneficial during tax season when you’re looking for ways to accommodate your finances. Here’s how the 80G exemption works:

- Contributions made to registered Indian organisations like Bal Raksha Bharat qualify for the income tax donation exemption. This way, your money goes towards significantly improving society by supporting programmes like education for underprivileged children. However, it is important to know that only donations to recognised organisations can help you avail of these benefits, so choosing wisely is key.

- Under Section 80G, individuals can claim donation rebate in income tax . For most donors, this means a 50% tax exemption on donation made to registered and well reputed organisations, which can significantly reduce your tax burden. By donating, you’re not only helping others but also improving your cash in hand.

- To avail of the donation exemption in income tax, it’s essential to provide your full name, complete address, and PAN number when making contribution. This information helps issue the 80G tax exemption certificate. This certificate is important for your records so that you can claim your donation tax deduction efficiently.

How Your Donation Makes a Difference

Donating to organisations like Bal Raksha Bharat is like investing in creating future for India’s underprivileged children. Since 2004, Bal Raksha Bharat has positively impacted over 10 million children, ensuring they have access to quality education, healthcare, and protection. Donating to these causes play an important role in this mission, showcasing the power of collective effort in driving social change.

Key Areas of Work

Education: The primary focus of Bal Raksha Bharat ‘s work in the area of education is to get deprived children into the educational system and keeping them there. Contributions from donors helps fund educational projects that provide resources, teaching staff, and essential materials for learning. Investing in education is investing in the future of the community and the nation.

Child Protection: Bal Raksha Bharat works tirelessly to shield children from abuse, neglect, and exploitation. Donation plays a crucial role in funding programs that safeguard children’s rights and provide them an environment that’s safe for children to thrive.

Health & Nutrition: Bal Raksha Bharat strives to support the government, aiming to give every child a healthy start. Your contributions help ensure access to healthcare for mothers and their children, improving overall well-being. Healthy children then tend to be better learners, and by supporting health initiatives, you help create a foundation for lifelong success.

Economic Well-being & Inclusion: Bal Raksha Bharat addresses the impact of poverty by supporting community livelihood initiatives. Our programmes help create sustainable income opportunities, empowering them to break the poverty cycle. By focusing on inclusion, we ensure that no child is left behind.

Resilience: In times of disaster, Bal Raksha Bharat provides immediate relief material for survival and dignity. Your donations ensure that children and their families can withstand and recover from emergencies. Resilience is not just about recovery; it’s about building a stronger future for everyone involved.

Looking at the above, by donating to organisations like Bal Raksha Bharat, you reap dual rewards: the emotional satisfaction of changing a child’s life and the financial benefit of saving on taxes. The donation under 80G qualifies for income tax donation exemption, which not only eases your tax burden but also brings joy and hope to children in need. This dual benefit shows how charity can be both an act of kindness and a smart financial step.

FREQUENTLY ASKED QUESTIONS

-

How much can I donate to claim the 80G tax exemption?

-

How does the 80G tax exemption work?

-

Do I need to keep records of my donation?

-

Can I donate anonymously and still claim the exemption?

The Bigger Picture of When You Donate

When you give your donation to other organisations like Bal Raksha Bharat, you also lend a helping hand for a good cause and that cause is to build a more just world for all. With each donation, the nation is engaged in the development of a self-sufficient generation that is educated and knows how to give back to their society.

Furthermore, you assist in highlighting issues that are dire and relevant to children. The more individuals know what underprivileged children have to face, the more chance there is to motivate them to take action and add to the efforts of the system. This is one of the universal movements, and you have contributed to it by making a statement about where you think society should be headed.

How to Go About It Further

Now, if you feel like you want to make more than just a donation, particularly if you have a passion for the causes supported by Bal Raksha Bharat, you may want to join them. You might want to provide mentorship, participate in awareness campaigns, or even help spread the word—every little effort counts, and your skills could be essential in great ways.

In addition, informing your friends, family, and social media about your thoughts can spread the message of difference further. By helping other people to also think about how they can help, we can create a wave of kindness towards vulnerable individuals. Plus, by donating, you can also benefit from a donation rebate in income tax, making your generosity not only impactful for those in need but also beneficial for your financial planning. Together, we can build a community that stands for change and support for the most marginalised.

Don’t wait for tomorrow, act now!

With your gift supporting Bal Raksha Bharat you take part in the struggle to build a better tomorrow for many innocent children.

OUR AREAS OF WORK

![]()

Education

We work to ensure that the most deprived children come into the fold of education and stay there

![]()

Child Protection

We work to keep children out of harm’s way and safeguard them from various forms of abuse, neglect and exploitation

![]()

Health & Nutrition

We work to give a healthy start to children along with ensuring better access to healthcare for new mothers and pregnant women

![]()

Poverty & Inclusion

We work with an aim to offset the impact of poverty in children’s lives along with providing livelihood support to communities

![]()

Resilience

We work to provide life-saving relief to children and their families during disasters and equip them to be better prepared to face emergencies

OUR AREAS OF WORK

![]()

Education

We work to ensure that the most deprived children come into the fold of education and stay there

![]()

Child Protection

We work to keep children out of harm’s way and safeguard them from various forms of abuse, neglect and exploitation

![]()

Health & Nutrition

We work to give a healthy start to children along with ensuring better access to healthcare for new mothers and pregnant women

![]()

Poverty & Inclusion

We work with an aim to offset the impact of poverty in children’s lives along with providing livelihood support to communities

![]()

Resilience

We work to provide life-saving relief to children and their families during disasters and equip them to be better prepared to face emergencies