How can companies benefit from supporting ngos & save on taxes?

Corporate support for non-governmental organisations (NGOs) offers India Inc a meaningful opportunity to create a positive social impact. It also serves as a strategic financial decision that offers substantial tax benefits. Businesses are increasingly recognising the value of corporate philanthropy and aligning business objectives with meaningful social causes. This enables them to enhance their brand reputation, build stronger community relations, and build powerful goodwill among clients, suppliers, employees and other stakeholders.

What is CSR fund and why is it important?

Partnerships with NGOs provide another advantage: optimising tax liabilities. The Government of India actively encourages corporate contributions toward social welfare through the CSR fund. But what is CSR fund? It is a mandated allocation under Section 135 of the Companies Act, 2013, requiring companies that meet specific financial thresholds to allocate a portion of their profits toward CSR activities. This not only ensures regulatory compliance but also contributes to nation-building.

The business case for supporting NGOs

Corporate engagement with NGOs, especially through the ambit of the CSR fund, brings tangible advantages. Companies that blend philanthropy and community welfare into their business model usually witness customer loyalty, stronger employee engagement, and enhanced goodwill among stakeholders – a trend that is visible in companies across the globe. This also enables them to build stronger relationships with public stakeholders at the governance levels, especially when they work in causes related to education, healthcare, sustainability, and women’s empowerment, as they are seen as active contributors and participants in India’s developmental goals, even as they reinforce their corporate identity and purpose.

Business and regulatory compliance

Supporting NGOs also helps businesses meet regulatory and compliance requirements. Under Section 135 of the Companies Act, 2013, companies that meet specific financial thresholds are required to allocate a portion of their profits toward CSR activities. This is why many firms either set up their own social initiatives or, more often than not, partner with registered NGOs to implement their CSR programmes effectively, ensuring both regulatory compliance and greater impact.

Access to development sector expertise

NGO partnership enables companies to access a wealth of experience, local developmental insight, and the ability to accelerate their impact than if they were to go at it alone or from scratch. Instead of creating in-house social programmes, which can be resource-intensive, companies can leverage the expertise of NGOs that specialize in grassroots implementation. By collaborating with established NGOs with a proven track record, businesses ensure regulatory compliance, optimise resource allocation, and generate measurable social impact. Corporate support for NGOs also plays a crucial role in brand positioning and reputation management.

Shared resources and vision

Additionally, corporate partnerships with NGOs open doors to developmental innovation and synergy, as businesses can look to co-develop sustainable solutions to pressing social issues using their unique breadth of expertise and resources. Companies in sectors such as renewable energy, education technology, healthcare, and financial inclusion benefit by engaging with NGOs that specialise in grassroots implementation, ensuring that interventions reach the intended beneficiaries, and make the most of the resources available.

Tax savings through corporate donations to NGOs

Coming back to tax benefits, which is one of the most compelling reasons for businesses to support NGOs. Contributions to registered charitable organisations are eligible for tax deductions under Section 80G and Section 35AC of the Income Tax Act. These provisions allow companies to claim deductions on donations, thereby reducing their taxable income and overall tax liability.

Under the purview of Section 80G donation, businesses donating to approved charitable institutions and relief funds can claim a 50% to 100% deduction on their contributions, depending on the category of the NGO. However, it’s important to note that the 80G donation limit stipulates that the deduction cannot exceed 10% of the company’s adjusted gross total income. For this, contributions must be in monetary form (cheques, bank transfers, or demand drafts; cash donations above ₹2,000 do not qualify). Further, the NGO must provide a donation receipt and Form 10BE to the donor for tax filing purposes.

In addition, Section 35AC allows companies to claim a 100% deduction on contributions made toward government-approved projects in areas such as education, rural development, and healthcare infrastructure. This provision serves as an incentive for businesses to participate in nation-building initiatives while reducing tax liabilities.

Read Also: Process of Deduction on Donations Under Section 80G

A win-win strategy for businesses & society

Supporting NGOs is, therefore, an opportunity for businesses to drive meaningful change while optimising financial efficiency and gaining tax and reputational benefits and strengthening their market presence.

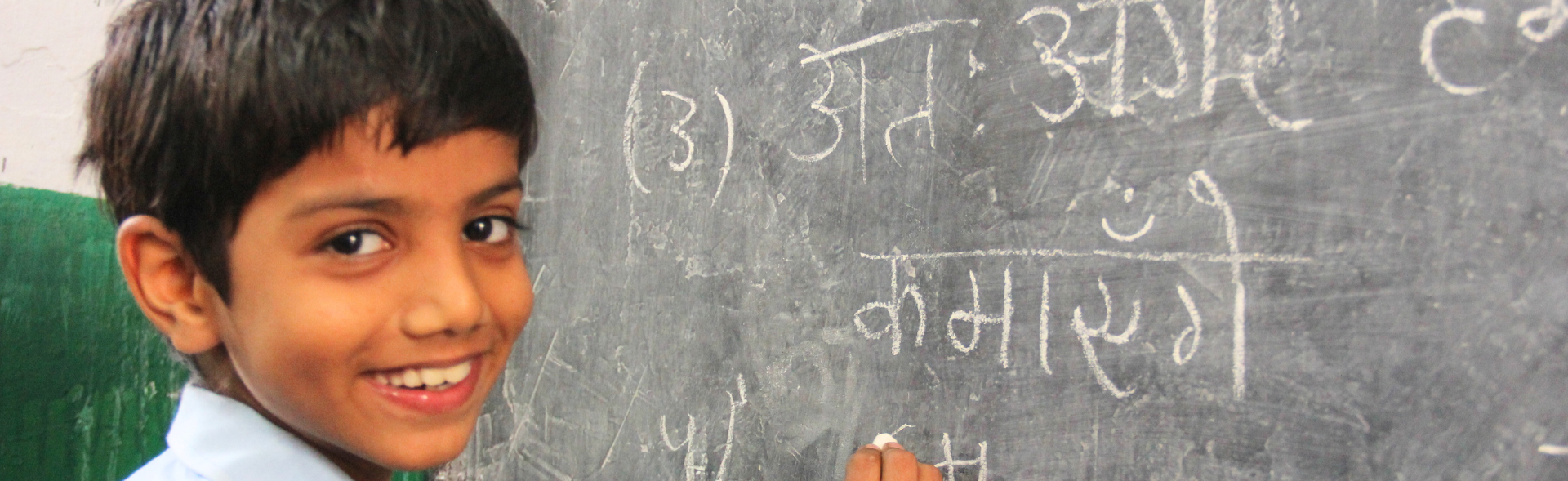

NGO Bal Raksha Bharat collaborates with corporate partners to implement Corporate Social Responsibility (CSR) initiatives aimed at improving the lives of underprivileged children. These partnerships focus on areas such as education, health and nutrition, child protection, and humanitarian response, leveraging the strengths and resources of both the corporate sector and the NGO to create a sustainable social impact. Bal Raksha Bharat works closely with corporate entities to develop and implement programmes that align with the company’s CSR fund objectives and the organisation’s mission to safeguard children’s rights.